Scotlands Financial Landscape

Background

Financial Services in Scotland is steeped in history, dating back to the opening of the Bank of Scotland in the 17th century. The growth of trade, both domestic and international, led to the development of Banking, Insurance and Asset Management industries and laid the groundwork for what is now the largest financial centre outside of London. There are now over 2,000 organisations that make up Financial Services in Scotland, employing over 160,000 people and it is the largest contributor to the Scottish economy!

Financial Services in Scotland is a diverse eco system. At its’ heart are the organisations that fall under Retail Banking, Investment Banking, Wealth and Asset Management, Insurance and Investment Accounting. Those organisations are also supported by and in partnership with a variety of different professional and support service firms, fintech and government agencies.

Connecting Talent with our Industry

Scotland has an amazing pipeline of talent coming from schools, colleges and universities and we must maintain our focus on ensuring that pipeline is as diverse as it can be. We have an incredible sector with a vast array of different roles available to new and experienced talent but it is that complexity of our landscape that must be demystified to ensure the opportunities within our industry are better understood. Understanding the industry will enable diverse talent to visualize a career pathway that they may otherwise have considered not to be a good fit.

What is Financial Services?

The role of Financial Services

Investment Functions

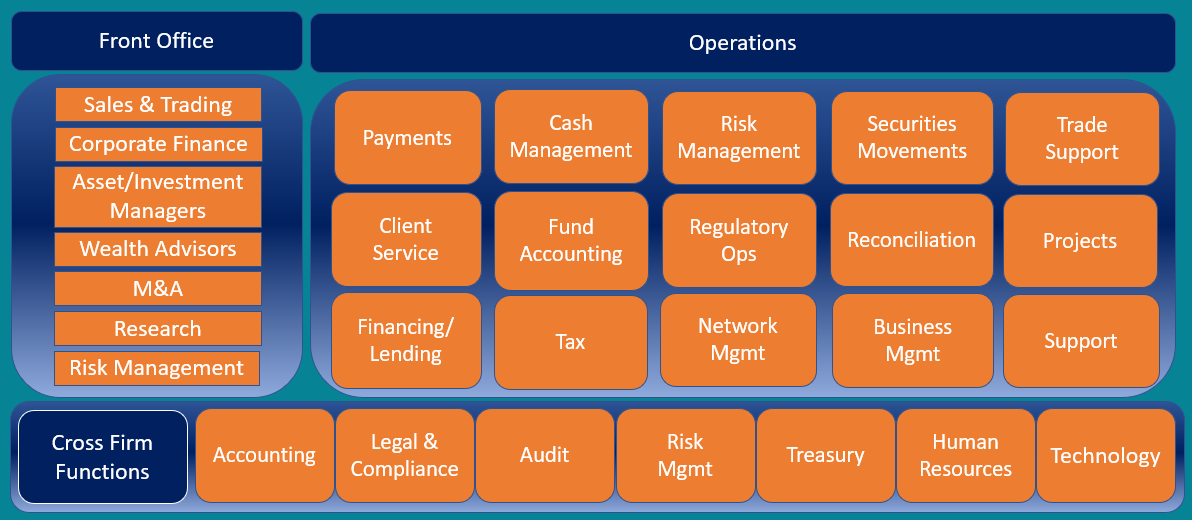

What is Operations?

The Operations division of an investment bank or investment management firm (also known as the 'back office') is the 'engine room' of a financial organisation, working to keep the vast quantities of information, money and products flowing correctly. It ensures millions of transactions are processed every day. The range of functions is diverse and depending on how they are structured organisationally, they can also be aligned with product or business line.

Transactionally driven functions like Payments, Securities Settlements and Trade Support are focused on the control and execution of cash and securities movements. For example, if a client buys 1,000 shares of Apple, the securities and cash relating to that transaction would need to be managed by Operations. Sometimes these transactions can be over £1 billion in value!

The Financing team are responsible for ensuring that trades have adequate liquidity in either cash or securities to enable settlement. They also support business flows that are focused on lending client assets to generate higher returns on their portfolios.

The Cash Management function ensures there is enough money to cover all activity across the firm’s bank accounts, working in partnership with the Treasury department. The team are also required to monitor and maintain liquidity within global regulations.

Post-trade functions like Regulatory Ops, Tax and Reconciliations are focused on exercising control, after trades have settled (cash and securities have been moved). Regulatory Ops looks at the application and compliance with various regulations such as Client Money which ensures all assets held by a firm, on behalf of their clients, can be recovered should that firm fall into bankruptcy. The Reconciliation function ensures that the books and records of a firm are balanced by comparing two or more data points. Tax Operations is responsible for capturing all tax obligations and ensuring they are balanced and paid to the relevant authorities.

Fund Accounting functions are responsible for ensuring that activity in Investment Funds is under control and that the value of each client’s holding in that fund is properly tracked and valued.

Risk Managers will ensure that the Operations teams are meeting the expectations laid out in procedures and regulations. They will exercise oversight and supervision to provide an independent view of the level of control in each Operational function.

As a general rule, most Operational functions require a degree of client service responsibilities, largely because every transaction tends to originate from a client and therefore has a potential impact that requires strong relationship management with internal business areas and external client contacts. Some times there is also a dedicated Client Service function which acts as a conduit between the client and the Operational functions.

Projects teams primary focus is to manage strategic projects that typically involve the renovation of technology to help to improve efficiency and control. Their responsibility is to manage the delivery of those projects as well as acting as a conduit between Operations and Technology.

Network Management will oversee the performance and relationship with the various suppliers that support a financial services firm. They will ensure contracts are appropriate and that suppliers meet the service levels expected of them.

Business Management and Support teams will often be functions that deal with common support processes, affecting the whole of Operations. This could be budget management, where individuals will forecast and manage expenditure or assistants who help to coordinate meetings or events.

This is in no way an exhaustive list of Operational functions which serves to underline the diverse nature of the Operations division. Whilst the demands on the individuals tends to be similar, each function will bring with it, a different set of challenges, which allows for a better match with each individual’s capabilities and traits.